31+ What is your borrowing capacity

Calculating your borrowing capacity implies collateral or security loan as well. 14 hours agoThe Buffalo Bills still have a long road ahead if they hope to win their first Super Bowl this season but the team certainly looked the part in Week 1.

Free 10 Loan And Security Agreement Templates In Ms Word Pdf Free Premium Templates

This term means the sum of the projected Balance of the Fund as of December 31 of a Contract Year plus any reinsurance purchased by.

. Debts may include minimum monthly credit card payments car payments student loans alimonychild support etc. Include your and your co-borrowers monthly debts. Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home.

Youll hear the term borrowing capacity on home loans your car loan. This ratio takes your annual housing. Your borrowing capacity is the amount a lender will lend you to buy a property.

It uses a median expenditure on basic expenses eg. View your borrowing capacity and estimated home loan repayments. A borrowing base is the amount of money a lender will loan to a company based on the value of the collateral the company pledges.

Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. Examples of Borrowing Capacity in a sentence. Your borrowing power or borrowing capacity is the maximum amount of money a lender will let you borrow for a mortgage.

Multiply your number by 100 to see your credit utilization as a percentage. Estimate how much you can borrow for your home loan using our borrowing power calculator. Your debt-to-income ratio is a metric that your loan officer will.

The borrowing capacity is calculated based on your income current assets your deposit amount existing. For example if you have a 5000 credit card limit and you owe 1000 on that card the math for. The first one is income.

While each lender has its own in-house method. Ross Le Quesne. So the level of income has probably the biggest impact on how.

Borrowing capacity is a calculation that indicates the amount of money a lender will offer you to purchase a property. The figure may become part of a lenders calculation when assessing your borrowing capacity. For example if you cannot meet the terms described in the loan you are at risk of losing significant assets.

To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. You can quickly estimate your borrowing capacity by using an online borrowing calculator. Thats because your income is one of the main things lenders look at when.

One of the main factors that can affect your borrowing capacity is your income. You will need to factor in your income details such as your salary bonuses or income. When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS.

That said if you have other loans over. Yeah Ill cover three things in regards to borrowing capacity today. What is the borrowing capacity for a home loan.

Buffalo dominated the Los. Welcome to the online mortgage application portal of CONNECT Dutch Caribbean.

Img003 Jpg

2

2

Vhfvghtyvzkekm

G201504061231515332622 Jpg

Sample Templates Sample Report Writing Format 46 Free Documents In Pdf Bb98e930 Resumesample Resumefor Report Writing Report Writing Format Essay Format

2

Capital Funding 6 Examples Format Pdf Examples

2

2

What Is A Renovation Loan Home Renovation Loan Renovation Loans Home Loans

31 Awesome Products That Will Make This Your Best Summer Ever Wine Wine Glasses Wine Gifts

Intacc 1 Finals 2019 Pdf

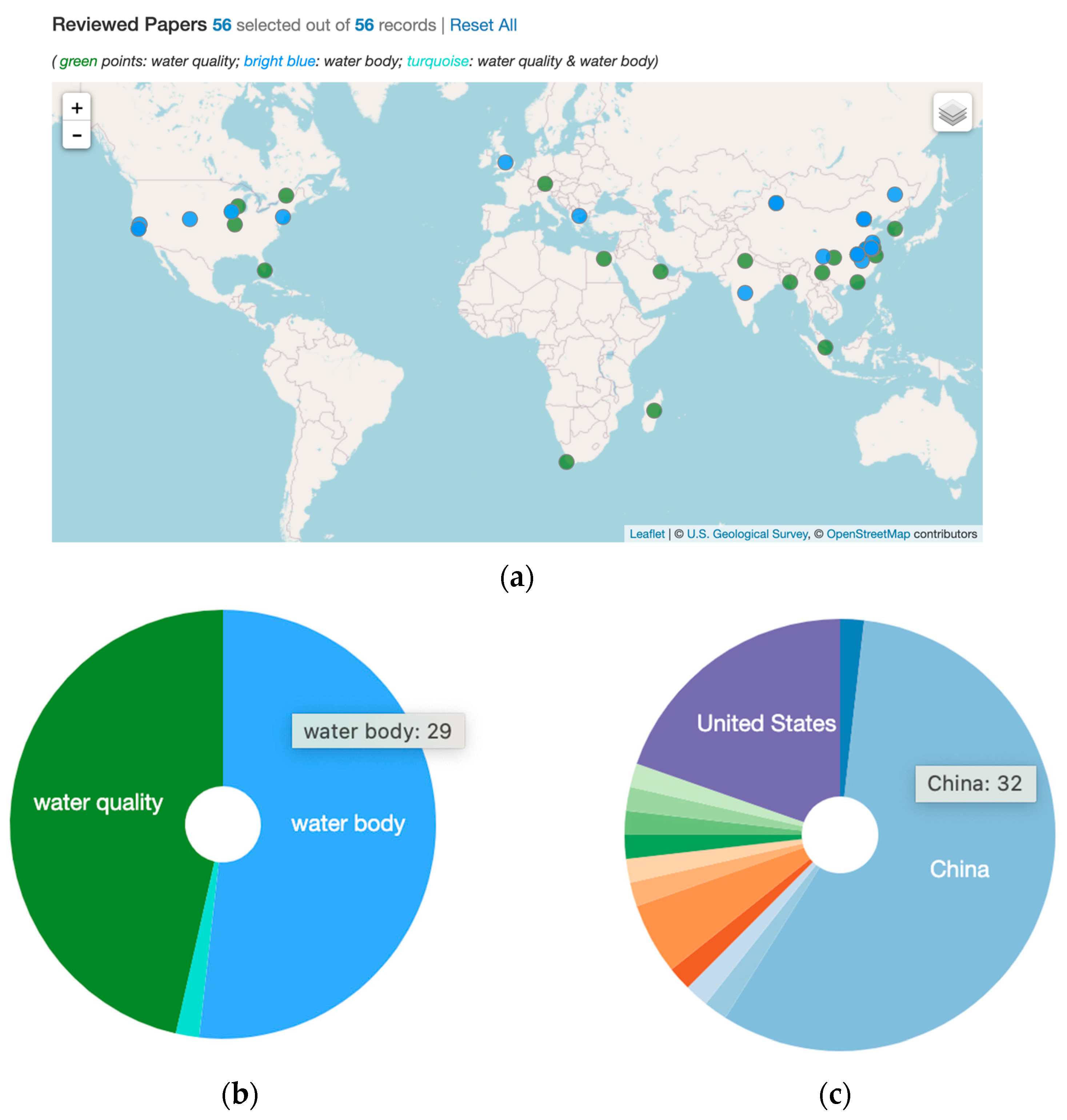

Sensors Free Full Text Towards Synoptic Water Monitoring Systems A Review Of Ai Methods For Automating Water Body Detection And Water Quality Monitoring Using Remote Sensing Html

G201504061231503922616 Jpg

Prosper 424b3 20160630 Htm

Img004 Jpg