32+ take home pay calculator hawaii

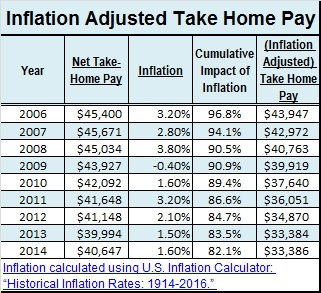

That means that your net pay will be 41883 per year or 3490 per month. Web Free Paycheck Calculator.

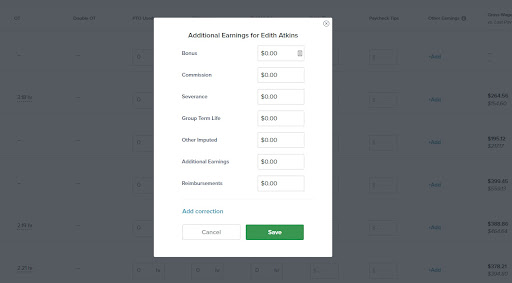

Bonus Pay How To Calculate Work Bonuses And Tax In 2023

14 - 110 Sales tax.

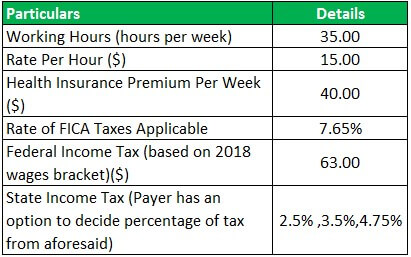

. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Hawaii. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Web Salary Paycheck Calculator Hawaii Paycheck Calculator Use ADPs Hawaii Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web The Hawaii Tax Calculator Estimate Your Federal and Hawaii Taxes C1 Select Tax Year 2021 2022 C2 Select Your Filing Status Single Head of Household Married Filing Joint. Web Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Well do the math for youall you. Take Home Pay for 2023.

We hope you found this Hawaii salary example informative and useful if you have time please take a few. Web How do I use the Hawaii paycheck calculator. Web To calculate your net pay or take-home pay in Hawaii enter your period or annual income along with the required federal state and local W4 information into our.

019 - 029 Income tax in Hawaii is progressive with a marginal tax rate starting as low as 14 and. Web Salary After Tax. Quick Facts Income tax.

Web As an employer in Hawaii you have to pay unemployment insurance to the state. Web On TurboTaxs Website If you make 70000 a year living in Hawaii you will be taxed 12921. Once done the result.

Simply follow the pre-filled calculator for Hawaii and identify your withholdings allowances and filing status. Web If you make 55000 a year living in the region of Hawaii USA you will be taxed 13118. It can also be used.

The 2023 tax rates range from 17 to 62 on the first 56700 in wages paid to. Your average tax rate is 1167 and your marginal tax rate is 22.

New Tax Law Take Home Pay Calculator For 75 000 Salary

Pc Magazine May 1990 Space Nerd Com

Hawaii Paycheck Calculator Tax Year 2023

6707 S Shelby Ridge Rd Spokane Wa 99224 Realtor Com

Hawaii Salary Paycheck Calculator Gusto

Almost Rich An Examination Of The True Cost Of City Living And Why Rich Is Never Rich Enough

32 Tips On Moving To Miami Fl Relocation Guide 2023

If I Am A Software Engineer Should I Only Focus In Programming In Order To Create Wealth Or Invest My Earnings In Stocks Quora

Texas Oil And Natural Gas June 2016 Peak Oil Barrel

2023 Gross Hourly To Net Take Home Pay Calculator By State

Bonus Pay How To Calculate Work Bonuses And Tax In 2023

Take Home Pay Definition Example How To Calculate

Definition Of Take Home Pay Math Square

If You Make 130 000 Year In Nyc What Is Your Take Home Bi Weekly Payment Quora

2023 Gross Hourly To Net Take Home Pay Calculator By State

1883 Us Highway 93 Hamilton Mt 59840 For Sale Mls 22216177

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee